Interactive Brokers (IBKR) is a globally recognized brokerage firm known for its deep market access, advanced trading platforms, and institutional-grade infrastructure.

Founded in 1977, the firm has evolved into one of the world’s largest and most trusted online trading platforms. As of the latest figures, IBKR maintains $17.5 billion in equity capital, underscoring its financial strength and operational stability. It is listed on the Nasdaq (Ticker: IBKR), and adheres to stringent corporate governance standards and regulatory oversight in multiple top-tier jurisdictions globally.

Interactive Brokers offers a unified trading experience through its proprietary platforms, including the Trader Workstation (TWS), Client Portal, and IBKR Mobile, all designed to offer seamless access to stocks, options, futures, forex, bonds, mutual funds, ETFs, and more. The firm’s focus on low costs, high execution speed, and deep liquidity continues to attract sophisticated market participants worldwide.

With a strong emphasis on innovation, regulation, and cost-efficiency, Interactive Brokers remains a top-tier choice for those seeking a powerful, flexible, and globally connected trading environment.

VISIT INTERACTIVE BROKERS →Broker Summary Table

| Estabished | 1977 |

| Headquaters | Greenwich, Connecticut, United States. |

| Regulation | SEC, FINRA (U.S.), FCA (UK), CBI (Europe/ Ireland), CIRO (Canada), SFC (Hong Kong), ASIC (Australia), MAS (Singapore), FSA (Japan), and SEBI (India). |

| Rating | 4.8/5.0 ★ |

| Products | Stocks, ETFs, Spot Currencies, Options, Futures/FOPs, Forecast & Event Contracts, US Spot Gold, Bonds, Mutual Funds, Hedge Funds |

| Platform | Client Portal (Web), IBKR Desktop, Trader Workstation (Desktop), IBKR Mobile, IBKR GlobalTrader (Mobile), TradingView |

| Account Opening | 1-3 Days |

| Account Types | Individual, Joint, Trust, IRA, and UGMA/UTMA. |

| Payment Methods | Bank Wire, Bank Transfer/ SEPA, eDDA, Check (Scan or Mail), ACH, Wise, Bill Pay, BPAY |

| Minimum Deposit | $0 |

| Account Currencies | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, TRY, SEK, SGD, ZAR, and USD. |

| Fees | Stocks/ETFs (US) IBKR Lite (Fixed Pricing): $0.005 per share IBKR Pro (Tiered Pricing): $0.005 to 0.0035 per share Spot Currencies: From 0.1 pips Bonds: 0.1% of Face Value per order Options IBKR Lite (Fixed Pricing): $0.65 per contract IBKR Pro (Tiered Pricing): $0.25 to $0.65 per contract Futures IBKR Lite (Fixed Pricing): $0.85 per contract IBKR Pro (Tiered Pricing): $0.25 to $0.85 per contract Mutual Funds: 3% of trade value (up to $14.95 per transaction) Cryptocurrency: 0.12% to 0.18% of trade value Inactivity Fee: $0 Margin Rates (USD): From 5.83% to 4.83% |

| Ideal Users | Professional Traders and Investors, Derivative Traders, Institutional Clients, High‑Volume Traders, Global Multi‑Asset Investors, Quantitative and Algorithmic Traders. |

Pros

- Strong regulatory framework.

- Exensive product range and global markets.

- Professional-grade platforms with algorithmic trading and API integration.

- Comprehensive educational hub (IBKR Campus) with free access to structured courses, webinars, and expert market insights.

- Offers a simplified mobile interface via IBKR Mobile.

- Supports multiple account types, including individual, joint, IRA, and institutional.

- Institutional-level order execution and routing.

- Ultra-low fees.

- Supports 27 base currencies.

- Advanced margin trading capabilities.

- Significantly lower margin rates compared to competitors.

Cons

- Platform complexity can overwhelm beginners.

- IBKR Lite is available only in the U.S.

- Customer support can be inconsistent during peak hours.

- Its complex pricing structure may confuse beginner traders.

Product Offering

Interactive Brokers offers one of the most diverse product lineups in the global brokerage space, with access to over 160 markets across 36 countries. Clients can trade stocks, ETFs, spot currencies, options, futures, options on futures, forecast & event contracts, bonds, mutual funds, and hedge funds through a single, integrated account.

- Stocks – Over 10,000+ global stocks on 90+ market centers.

- ETFs – Over 15,000 ETFs globally across 90+ market centers.

- Spot Currencies – 100+ currency pairs available.

- Options – Global options across 30+ market centers.

- Futures – Global commodity futures on 30+ market centers.

- Bonds – Over 1 million bonds globally.

- Mutual Funds – Over 48,000 funds globally, including 19,000+ no-load/NTF funds.

Trading Platform

Interactive Brokers is widely recognized for offering one of the most powerful and versatile trading platforms in the global brokerage space. Its trading technology is built to meet the rigorous demands of professional traders, institutions, and active investors, delivering speed, precision, and seamless access to global markets.

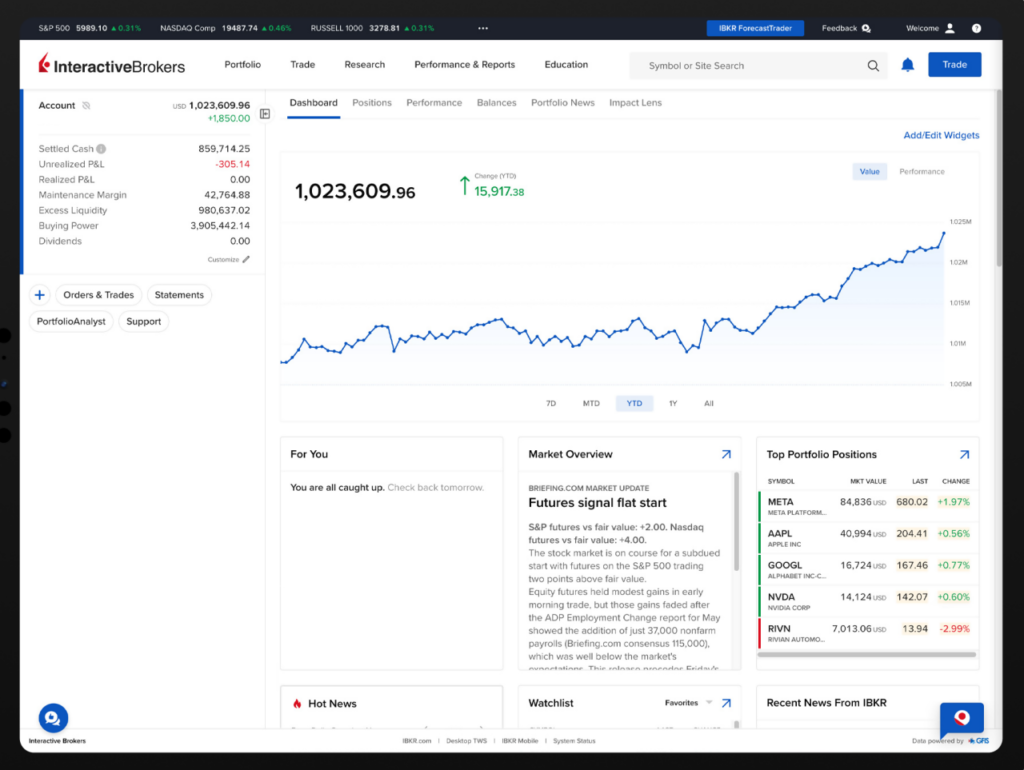

Web Platform

For those who prefer web-based access, IBKR Client Portal provides a clean interface for managing accounts, executing trades, tracking performance, and accessing research. It is ideal for everyday trading activity and account monitoring.

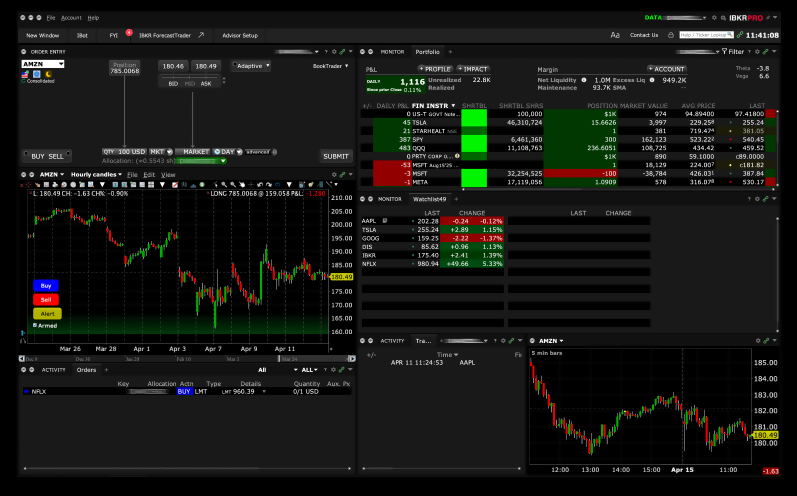

Desktop Platform

At the center of IBKR’s platform suite is the award-winning Trader Workstation (TWS), a desktop application designed for high-performance, multi-asset trading. It supports advanced order types, real-time risk analytics, and sophisticated charting. With TWS, traders can execute complex strategies across multiple asset classes, including stocks, options, futures, forex, and bonds, all from a single, customizable interface.

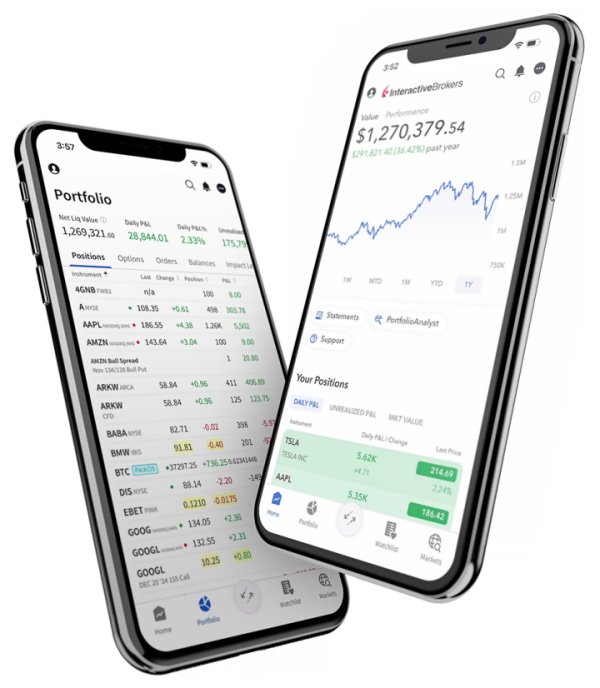

Mobile App

On mobile, the IBKR Mobile app ensures that users remain connected to markets wherever they are. The mobile app offers a streamlined experience with full trading capabilities, real-time data, alerts, and charting tools.

In addition to its native platforms, Interactive Brokers also offers APIs and FIX connectivity for developers, algo traders, and institutions seeking full programmatic control over their strategies. The broker’s platform ecosystem is further enhanced by integrations with third-party software providers and advanced research tools.

Taken together, these platform options reflect IBKR’s dedication to flexible and high-performance trading technology, tailored to suit a range of trading styles and professional workflows.

Research and Tools

Interactive Brokers offers a sophisticated suite of research resources and trading tools that cater to the needs of professional investors, active traders, algorithmic traders, and institutional clients. These tools are designed to support data-driven decision-making, improve risk management, and enhance execution efficiency across global markets.

Research and analytics on Interactive Brokers are seamlessly embedded into the Trader Workstation (TWS), Client Portal, and mobile apps. From institutional-grade market intelligence to customizable portfolio analysis and cutting-edge execution features, the broker’s infrastructure supports every phase of the trading lifecycle (from pre-trade planning to post-trade evaluation).

The table below provides a structured overview of the core research features and trading tools offered by Interactive Brokers.

| Category | Tools & Features |

|---|---|

| Account Management | Client Portal, Stock Yield Enhancement Program, IB Risk Navigator, Fractional Shares, Securities Loan Borrow, and Recurring Investments. |

| Research | Fundamentals Explorer, Bond Search Tool, Mutual Funds Search Tool, Environment, Social and Governance (ESG), Social Sentiments by Social Market Analytics (SMA), IBKR GlobalAnalyst, Securities Lending Dashboard, News & Research, and Discover. |

| Portfolio | Strategy Builder, Impact Dashboard, Custom Indexing, Rebalance Portfolio Tool, Stock/ETF Benchmarker, Mutual Fund/ETF Replicator, Tax Loss Harvest Tool, and Securities Class Action Recovery Solution. |

| Advisors | Strategy Builder, Model Market Place, Model Portfolios, Allocation Order Tool, IBKR Block Trading Desks, Tax Loss Harvesting Tool, and Securities Class Action Solution. |

| Trading | Accumulate/Distribute Algo, Bracket Orders, Exit Strategy, TWS Layout Library, FXTrader, Split Spread, Options Liquidity Tool, Excel and the TWS API, Attach an FX Order to Trades, TradingView, BookTrader, Portfolio Performance Profile, Integrated Stock Window, IBKR Forum, Overnight Trading Hours, Tax Loss Harvesting, and Recurring Investments. |

| Options | Write Options Tool, Rollover Options Tool, Rollover Options Tool, Mobile Options Trading, Volatility Lab, ComboTrader, Option Trader, Options Liquidity Pool, Options Portfolio, Option Analytics, Option Strategy Lab, Neural Option Market Strategies, and Options Wizard. |

With these comprehensive tools and extensive research capabilities, Interactive Brokers empowers its clients to not only trade but trade intelligently.

Account Opening

Opening an account with Interactive Brokers (IBKR) is a fully digital process designed to accommodate both individual and institutional clients across a wide range of jurisdictions. The onboarding process is streamlined through IBKR’s secure Client Portal, offering a step-by-step interface that supports account applications in multiple languages.

New users are guided through a verification process that typically involves submitting personal or corporate information, proof of identity, tax documentation, and linking a bank account. While application approval times may vary based on account type and jurisdiction, most individual retail accounts are opened within 1 to 3 business days, provided that all required documents are submitted accurately.

Once approved, clients can fund their account in any of the supported 24 base currencies and begin trading across IBKR’s global platform. No minimum deposit is required to open an Individual account, though certain products (like margin trading or options) may require specific funding thresholds.

Account Types

Interactive Brokers provides a broad selection of account types to match different client profiles and regulatory requirements, all with access to its full suite of global trading products and tools. Supported account types on IBKR include Individual, Joint, Trust, IRA, UGMA/UTMA (U.S.), as well as accounts for institutions, advisors, family offices, money managers, hedge funds, and brokers.

The table below contains a summary of all IBKR’s account types and a brief description of who each type is intended for:

| Account Type | Description |

|---|---|

| Individuals | Accounts for a single individual. |

| Joint | Account for two individuals sharing account ownership and trading responsibilities. |

| Trust | A single account controlled by a trustee with settlors and grantors. |

| IRA | A tax-advantaged account designed to help individuals save for retirement. |

| UGMA/UTMA | A single account for minors, managed by a single custodian user. |

| Non-Professional Advisor | A master account linked to individual client accounts. |

| Family Office | An individual master account linked to multiple client accounts. |

| Small Business | A single account that holds assets owned by the entity account holder. |

| Advisor | A master account linked to individual or organization client accounts. |

| Money Manager | A separate client account for a client whom a Money Manager manages money. |

| Broker & FCM | A master account linked to an individual or organization client accounts. |

| Proprietary Trading Group | A single account that holds assets owned by the entity account holder. |

| Hedge Fund & Mutual Fund | A single fund account with one or more users, managed by an investment manager. |

| Compliance Officers | A single account linked to multiple individual, joint, trust, and IRA employee accounts to monitor their trading activity. |

| Administrators | A single account linked to multiple Advisors, Single or Multiple Hedge Fund, and Proprietary Trading Group accounts to provide reports and other administrative functions to one or more clients, funds, or sub-accounts. |

| Institutional Hedge Fund Investors | A single account for institutions such as an endowment, foundation, pension, family office, or funds that want to access the Hedge Fund Marketplace to browse and invest in hedge funds. |

Fees

Interactive Brokers is one of the lowest-cost brokers globally. It offers two pricing models: IBKR Lite (US only) and IBKR Pro (Global), and both charge very low fees compared to other industry standard brokers and competitors.

The table below contains a breakdown of IBKR’s fees across various asset classes and pricing models:

| Asset | IBKR Lite (US) | IBKR Pro (Fixed) | IBKR Pro (Tiered) |

|---|---|---|---|

| US Stocks & ETFs | $0 per trade | $0.005 per share | $0.0005 to $0.0035 per share |

| Options | $0.65 per contract | $0.65 contract | $0.15 to $0.65 per contract |

| Futures | $0.85 per contract | $0.85 per contract | $0.25 to $0.85 per contract |

| Spot Currencies | From 0.1 pips + $2 commission per lot | From 0.1 pips + $2 commission per lot | 0.20 to 0.08 basis point per trade value |

| Cryptocurrency | 0.18 – 0.12% of trade value (min $1.75) | 0.12–0.18% (min $1.75) | 0.12–0.18% (min $1.75) |

| Mutual Funds | $0 | $0 | $0 |

Non-Trading Fees

In addition to trading commissions and spreads, Interactive Brokers applies non-trading fees depending on account activity, services used, and market access. These fees are generally low and transparently disclosed, but may still impact cost-sensitive traders over time.

The table below provides an overview of non-trading fees associated with IBKR accounts.

| Account Fee | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $10 (varies by currency and method) 1 free withdrawal per calendar month |

| Conversion Fee | 0.03% |

| Custody Fee | $0 |

| Inactivity Fee | $0 |

| Margin Rates | IBKR Lite: 6.83% IBKR Pro: From 5.83% to 4.83% |

Deposit and Withdrawal

Depositing and withdrawing funds with Interactive Brokers is secure, efficient, and globally accessible. Both deposits and withdrawals are managed through the Client Portal, ensuring a centralized and streamlined experience for all account types.

With IBKR, funds can be transferred in multiple currencies via bank wire, direct ACH, or domestic transfer systems such as SEPA (Europe), FPS (Hong Kong), and BPay (Australia). While the broker supports clients in over 200+ countries and territories, specific funding options and processing times may vary by region and currency.

| Payment Methods | Bank Wire, Bank Transfer/ SEPA, eDDA, Check (Scan or Mail), ACH, Wise, Bill Pay, BPAY |

| Processing Time | 1–3 business days, depending on method and currency |

| Supported Currencies | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, TRY, SEK, SGD, ZAR, and USD. |

| Minimum Deposit | No minimum deposit required to open an account |

Education

Interactive Brokers emphasizes education, offering an expansive suite of learning resources designed to empower both beginner and advanced investors. Through its educational hub, IBKR Campus, the broker delivers high-quality, structured educational resources that span markets, strategies, platform guides, and risk management.

IBKR’s educational ecosystem includes webinars, video tutorials, market commentary, user guides, and interactive courses, available globally and in multiple languages. Whether you’re new to trading, a professional, or a quant trader, IBKR offers targeted learning paths to support your growth. The platform’s Traders’ Academy covers a wide array of asset classes and trading concepts, while IBKR Quant and Student Trading Lab cater specifically to academic institutions, programmers, and algorithmic traders.

From platform onboarding to professional trading insights, IBKR’s educational resources are designed to be self-paced and practical. This educational commitment aligns with IBKR’s broader mission to support informed and confident trading decisions across all levels of experience.

Regulation and Compliance

Interactive Brokers operates under one of the most robust regulatory frameworks in the global financial services industry. Its global presence is supported by licenses and oversight from leading financial authorities across multiple jurisdictions. This multi-layered regulatory coverage reflects its dedication to transparency, operational compliance, and investor protection.

By maintaining strong relationships with leading financial regulators, Interactive Brokers ensures that its operations remain compliant with market standards and client protection requirements. Its long-standing reputation for transparency and trustworthiness is reinforced by its regulatory affiliations, making it a safe broker for investors to work with.

Interactive Brokers Regulated Entities

The table summarizes the regulated entities through which Interactive Brokers operates globally.

| Operating Country | Entity | Regulator | Protection Amount |

|---|---|---|---|

| USA | Interactive Brokers LLC | US Securities and Exchange Commission (SEC) SEC, FINRA | $500,000 |

| UK | Interactive Brokers (U.K.) Limited | Financial Conduct Authority (FCA) | £85,000 |

| EU/ Ireland | Interactive Brokers Ireland Limited | Central Bank of Ireland (CBI) | €20,000 |

| Canada | Interactive Brokers Canada Inc. | Canadian Investment Regulatory Organization (CIRO) | CAD 1,000,000 |

| Hong Kong | Interactive Brokers Hong Kong Limited | Hong Kong Securities and Futures Commission (SFC) | HKD 500,000 |

| Australia | Interactive Brokers Australia Pty. Ltd. | Australian Securities and Investments Commission (ASIC) | None |

| Singapore | Interactive Brokers Singapore Pte. Ltd. | Monetary Authority of Singapore (MAS) | None |

| Japan | Interactive Brokers Securities Japan Inc. | Financial Service Agency (FSA) | None |

| India | Interactive Brokers India Pvt. Ltd. | Securities and Exchange Board of India (SEBI) | None |

Each entity is registered and authorized in its respective jurisdiction, ensuring that client accounts are opened and maintained in compliance with local financial regulations. The entity assigned to a client depends on the country of residence and the applicable regulatory requirements.

This structure allows Interactive Brokers to provide localized services while maintaining a consistent global standard for security, transparency, and operational compliance.

Customer Support

Interactive Brokers offers a structured and professional customer support system designed to serve a diverse, global client base. The firm recognizes the importance of responsive assistance, especially for active and institutional traders operating across multiple time zones and markets. Its support infrastructure is built to provide timely, accurate, and knowledgeable responses to a wide range of client inquiries.

With IBKR, Clients can access support through multiple channels, including phone, email, live chat, and secure message centers within the Client Portal. These services are available 24 hours a day, 6 days a week, reflecting Interactive Brokers’ global nature. The support teams are segmented by region and product specialization, ensuring that inquiries are handled by representatives who are familiar with the regulatory environment and product set relevant to the client.

Interactive Brokers also maintains a comprehensive online Knowledge Base and FAQ center, which serves as a self-service resource for common account, trading, and platform-related questions. Additionally, support is integrated into the Trader Workstation (TWS) and Client Portal, allowing clients to submit tickets or chat with a representative without leaving the trading environment.

While the support service is generally efficient, it is optimized for self-directed traders and professionals who are comfortable navigating digital help channels and documentation. For those who require dedicated assistance, such as institutions or advisors, IBKR provides relationship management and tailored onboarding support.

With its well-organized support model, Interactive Brokers ensures that clients have access to the help they need to manage their accounts and resolve issues, all within a framework that values speed, compliance, and global reach.

Final Verdict

Interactive Brokers is one of the most comprehensive, institution-grade brokerage platforms available to global investors and professional traders. With over 45 years of industry experience, the firm has built a reputation for delivering unmatched market access, advanced trading technology, and institutional-grade pricing.

While the platform’s learning curve can be steep for beginners, its infrastructure makes it well-suited for active traders, high-volume traders, algorithmic strategists, and institutions. At the same time, the broker’s robust regulatory standing, spanning across North America, Europe, Asia-Pacific, and beyond, offers clients a strong sense of security and transparency.

In summary, for traders and investors seeking depth, flexibility, and long-term value in a regulated environment, Interactive Brokers remains one of the most compelling choices in today’s global brokerage landscape.