Saxo is a globally renowned investment and trading powerhouse, known for delivering institutional-grade tools and services. The broker offers a premium trading experience with strong regulatory backing, a broad product range, advanced trading platforms, and competitive pricing.

Saxo offers trading and investment products with access to over 72,000 global financial markets, including stocks, ETFs, mutual funds, commodities, forex, bonds, options, futures, and CFDs. Clients can trade short-term through CFDs, forex, options, and futures. Conversely, long-term investors are offered access to a broad selection of stocks, ETFs, investment funds, bonds, and Crypto ETFs.

Saxo’s diverse product offering is further supported by its advanced proprietary platforms, deep liquidity, robust research, competitive pricing, and tiered pricing model. Together, these elements make Saxo an ideal broker for active traders, high-volume traders, and long-term investors.

VISIT SAXO →Broker Summary Table

| Estabished | 1992 |

| Headquaters | Copenhagen, Denmark. |

| Regulation | FSA (Denmark/ Europe), FCA (UK), ASIC (Australia), MAS (Singapore), FINMA (Switzerland), SFC (Hong Kong), FSA (Japan), Consob (Italy), National Bank of Belgium & FSMA (Belgium), Bank of Brazil (Brazil), Czech National Bank (Czech), Central Bank of U.A.E (U.A.E.), Banque de France & AFM (France) |

| Rating | 4.9/5.0 ★ |

| Products | Cash Products – Stocks, ETFs, Investment Funds, Bonds, Crypto ETFs Leveraged Products – Forex, Options, CFDs, Stocks, Forex Options, Crypto FX, Futures, Commodities, Turbo, ETFs, Mutual Funds, and Bonds. |

| Maximum Leverage | 1:30 Professional Client: 1:66 |

| Platform | SaxoInvestor (Web and Mobile), SaxoTraderGO (Web and Mobile), SaxoTraderPRO (Desktop Only), TradingView, OpenAPI for Excel, and MultiCharts. |

| Account Opening | 1-2 Days |

| Account Types | Demo, Individual, Joint, Corporate, Professional, Institutional. |

| Account Tiers | Classic, Platinum, VIP |

| Payment Methods | Bank Transfer, Debit Cards, and Portfolio Transfer |

| Minimum Deposit | $0 |

| Account Currencies | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, INR, ILS, JPY, MXN, NOK, NZD, PLN, SEK, SGD, ZAR, TRY, and USD. |

| Fees | Stocks (US): From $1 ETFs (US): From $1 Bonds: From 0.05% Futures: $1 Per Contract Options: $0.75 Per Contract Mutual Funds: $0 Inactivity Fee: $0 |

| Customer Support | |

| Ideal Users | Professional Traders and Investors, Derivative Traders, Margin Traders, High Volume Traders, and Institutional Clients (Banks, Brokers, Corporates, Family Offices, Fund Managers, IAM, EAM, DFM, IFA, and Prop Traders) |

Pros

- Strong regulatory framework.

- Extensive product offering across global markets.

- Award-winning proprietary trading platforms.

- Competitive pricing for active traders.

- Rich research and educational resources.

- Multi-language and multi-currency support for international clients.

Cons

- High minimum deposit for premium accounts.

- Complex fee structure for beginners.

- No commission-free trading on stocks or ETFs.

- No MT4 or MT5 platform support.

- Inactivity fees apply.

- No support for e-wallets like PayPal or Skrill.

- Customer support service can vary by region.

- Limited crypto access compared to some brokers.

Product Offering

Saxo offers one of the most comprehensive product selections in the online trading industry, with a wide choice of markets and instruments to trade on. Clients can access over 71,000 financial instruments across various global financial markets, including stocks, ETFs, mutual funds, commodities, forex, bonds, options, futures, and CFDs.

| Stocks | 23,000+ stocks from New York, Hong Kong, London, and 50+ other markets. |

| ETFs | 7,400+ ETFs from tech, healthcare, environmental, and other major sectors. |

| Bonds | 5,200+ government and corporate bonds from around the world. |

| Mutual Funds | 18,300+ funds from the world’s top money managers. |

| Crypto ETFs and ETNs | ETPs tracking bitcoin, ethereum, ripple, tezos, and others. |

| Forex | 185+ forex pairs across majors, minors, exotics, and metals. |

| Forex Options | 45+ FX vanilla options with maturities from one day to 12 months. |

| Listed Options | Options on stocks, indices, interest rates, and futures from 20+ exchanges. |

| Futures | 250+ futures covering equity indices, energy, metals, rates, and more. |

| CFDs | 8,600+ CFDs on single stocks, indices, forex, commodities, and more. |

| Commodities | Range of commodities to trade as CFDs, futures, spot pairs, ETCs, and more. |

This diverse range supports advanced portfolio diversification and strategy execution for investors of all types.

Trading Platform

Saxo offers a robust and flexible trading environment built around two award-winning proprietary platforms: SaxoTraderGO and SaxoTraderPRO. Both platforms are engineered in-house and tailored to meet the needs of a wide range of traders and investors beginners to professional traders.

SaxoTraderGO

SaxoTraderGO is a web-based trading platform designed to deliver a seamless and powerful experience for traders and investors of all levels. The platform is accessible through any modern browser and is compatible with desktop and mobile devices, enabling seamless access and function across devices.

The platform is equipped with a wide range of tools for technical and fundamental analysis. For technical analysis, users can access real-time charts with over 40 technical indicators, drawing tools, multiple order types, and automated trade signals. Its fundamental research tools include equity overviews, analyst sentiment, financial statements, in-platform news, and insights from Saxo experts and trusted third-party sources.

For portfolio oversight, SaxoTraderGO provides a detailed account overview with real-time updates, performance dashboards, time-weighted return analyses, and historical reports. Risk management is reinforced with features like the Account Shield, trailing stops, stop-limit orders, margin alerts, and one-click cancellation of all pending orders.

SaxoTraderGO requires no subscription fees and is fully supported by dedicated mobile apps for iOS and Android. Platform tutorials are also provided within the interface to facilitate a smooth learning curve for new users.

SaxoTraderPRO

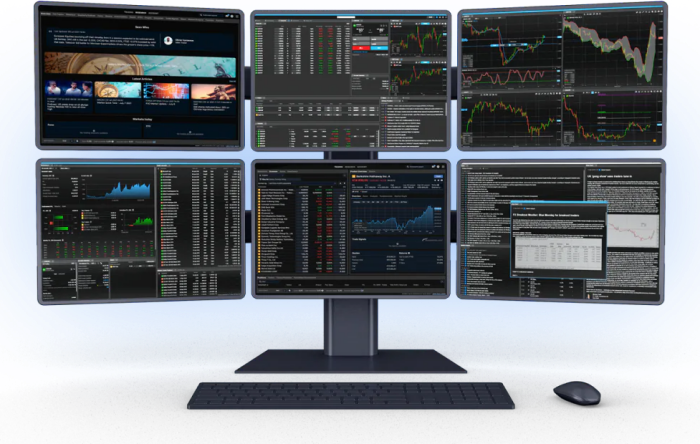

SaxoTraderPRO is a downloadable desktop application (for Mac and Windows) that provides an advanced and customisable trading environment for professional traders. It supports a multi-screen setup, allowing users to design and configure multiple workspaces tailored to their unique preferences and trading strategies.

Its advanced trading features include a powerful trade ticket designed for speed and accuracy, offering streamlined order placement with minimal clicks. Real-time Level II market data is available through tools like Depth Trader and Time and Sales, delivering full visibility into market depth and trade flow. Additionally, the platform supports integrated algorithmic order types, a flexible option-chain module for fast access to listed and FX options, and over 50 technical indicators and drawing tools within the charting suite.

For risk management, SaxoTraderPRO offers robust tools such as the Account Shield, which automatically closes open positions when the overall account value falls below a specified threshold. Other risk management tools include trailing stops, stop-limit orders, one-click cancellation of pending orders, margin alerts, and quick-close options for leveraged positions.

The platform’s comprehensive account overview provides real-time performance tracking, time-weighted return metrics, and downloadable reports. It is available at no extra cost, with optional subscriptions for enhanced data feeds. Collectively, these capabilities establish SaxoTraderPRO as a powerful trading platform for executing complex trading strategies.

Account Opening

Saxo offers a fully digital account opening process that is straightforward, fast, and secure. The onboarding process can be completed online, with document uploads, identity verification, and approval, all handled digitally.

Account opening with Saxo typically takes 1 to 2 days, depending on the accuracy of the information provided. Applicants are required to submit valid identification, proof of residence, and complete a short suitability questionnaire. This ensures that Saxo aligns its services with the client’s financial profile, investment knowledge, and trading experience.

Once your account application is approved, the onboarding department will email you all the necessary information, including your SaxoID, log-in credentials, and payment information. Overall, Saxo’s account onboarding process is fast and seamless, enabling clients to start investing with minimal delay.

Account Types

Saxo offers a variety of account types, including demo, individual, professional, joint, corporate, and institutional accounts, allowing clients to select an account structure that suits their requirements.

The table below provides an overview of the main account types available at Saxo and their descriptions:

| Account Type | Description |

|---|---|

| Demo | A risk-free simulated account that allows users to explore Saxo’s platforms and test trading strategies without using real funds. |

| Individual | Designed for personal trading and investment, with full access to Saxo’s platforms and broad product range. |

| Professional | Intended for experienced traders who meet specific eligibility criteria, enabling higher leverage and advanced trading features. |

| Joint | Offers shared access and control between two account holders. |

| Corporate | Tailored for businesses and professional entities, with multi-user access, advanced reporting tools, and dedicated support. |

| Institutional | Built for banks, brokers, fund managers, family offices, and prop traders. |

Additionally, Saxo provides access to three account tiers: Classic, Platinum, and VIP, each offering different levels of pricing, support, perks, and features.

- Classic Account: The Classic account is the entry-level option, requiring no minimum funding to open. It provides competitive pricing, access to SaxoTraderGO and SaxoTraderPRO, and standard customer support.

- Platinum Account: The Platinum account requires a minimum funding of $200,000 and introduces up to 30% lower trading costs and access to priority client support.

- VIP Account: At the highest level, the VIP account is available to clients who fund their account with $1,000,000 or more. It offers the most competitive pricing, a dedicated relationship manager, exclusive event invitations, and direct access to the SaxoStrats team for advanced market insights and personalised portfolio guidance.

Each account tier is crafted to deliver added value through enhanced pricing, support, perks, and exclusive features. This tiered structure allows Saxo to serve a diverse client base with different levels of experience, capital, and service expectations.

Ultimately, Saxo’s flexible account structure allows clients to select an account that suits their requirements and seamlessly grow within the platform as their trading needs and investment goals evolve.

Fees

Saxo offers low fees, particularly advantageous for active traders and high-volume participants. The broker’s fee model combines commissions, spreads, overnight financing, and volume-based tiered pricing across a wide range of asset classes.

Saxo’s fee structure is designed to reward client engagement, with lower costs and enhanced support provided through its Classic, Platinum, and VIP account tiers. This tiered model allows traders to benefit from increasingly favourable pricing as their trading volume or deposit level grows.

The table below provides an overview of Saxo’s fees for various financial instruments across its three account tiers: Classic, Platinum, and VIP.

| Instrument | Classic | Platinum | VIP |

|---|---|---|---|

| Stocks & ETFs | 0.08% | 0.05% | 0.03% |

| Forex (EUR/USD) | 0.9 pips | 0.8 pips | 0.7 pips |

| Futures | $3 per contract | $2 per contract | $1 per contract |

| Options | $2 per contract | $1 per contract | $0.75 per contract |

| Bonds | 0.2% | 0.1% | 0.05% |

| Mutual Funds | $0 | $0 | $0 |

| CFDs (Stock & ETFs CFD) | $0.02 | $0.015 | $0.01 |

Non-Trading Fees

In addition to trading fees, Saxo applies standard charges such as conversion fees, inactivity fees, and custody fees for certain products. Most services on the platform are free, while others are generally very low and clearly outlined in advance, ensuring users are well-informed.

The table below outlines Saxo’s general account fees, covering key charges associated with maintaining and using your account.

| Account Fee | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Conversion Fee | 0.25% |

| Custody Fee | Stocks, ETFs/ETCs, and Bonds Classic Account – 0.15 % Platinum Account – 0.12 % VIP Account – 0.09 % |

| Manual Order Fee | $50 per order |

| Inactivity Fee | $0 |

Deposit and Withdrawal

Saxo offers a secure and streamlined process for both deposits and withdrawals. However, its deposit and withdrawal methods are limited to bank transfer and debit card payments.

Deposits on Saxo can be made via bank transfer and debit card payments. There are no fees charged on incoming deposits, but third-party banks or card providers may apply their charges. The processing time for deposits ranges from one to three business days, depending on the method and originating bank.

Withdrawals on Saxo are processed only through bank transfer. For security reasons, withdrawals must be requested from the Saxo client platform and are allowed only to accounts that have been verified to belong to you. There are no withdrawal fees, and withdrawal requests are processed within one business day, although the funds may take an additional one to three business days to reach your bank account, depending on your region and the banking systems involved.

Below is an overview of Saxo’s supported payment methods, processing times, accepted currencies, and minimum funding requirements.

| Payment Methods | Bank Transfer and Debit Cards |

| Processing Time | 1-2 days |

| Supported Currencies | AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, INR, ILS, JPY, MXN, NOK, NZD, PLN, SEK, SGD, ZAR, TRY, and USD. |

| Minimum Deposit | $0 |

Research

Saxo delivers a well-rounded and professional research experience, integrated directly into its proprietary platforms. Its research features are designed to assist traders and investors in making informed decisions by offering a mix of real-time data, market commentary, and in-depth analysis.

At the core of Saxo’s research offering is its in-house SaxoStrats team of experienced strategists who produce daily insights, macroeconomic outlooks, and trade ideas across various asset classes. These include equities, forex, options, bonds, and commodities. Content is presented in various formats, including articles, videos, and podcasts, making it convenient for users to stay updated on market trends in a format that suits their preferences.

Complementing its internal expertise, Saxo integrates high-quality third-party research from leading providers such as Morningstar and NewsEdge. Together, these features provide a rich research environment that supports confident, data-driven trading and investment decisions.

Education

Saxo’s commitment to client education is evident in the breadth and quality of its learning materials, which range from foundational content for beginners to in-depth insights for experienced market participants.

Educational content on Saxo is delivered through articles, on-demand videos, live webinars, platform tutorials, and in-depth courses. These materials cover a wide range of topics such as trading strategies, market analysis, risk management, and platform functionality.

In addition to its structured educational content, Saxo also offers regular updates and market commentary from in-house experts, helping clients stay informed about economic trends and trading opportunities.

Regulation

Saxo operates under a strong regulatory framework, ensuring a high level of trust, transparency, and client protection across all its global operations. The broker is authorised and supervised by several top-tier financial regulators, reinforcing its reputation as a safe and reliable broker.

The Saxo Group is headquartered in Copenhagen, Denmark, and is regulated by the Danish Financial Supervisory Authority (FSA). Additionally, its subsidiaries are licensed by other leading financial authorities across the world, including the Financial Conduct Authority (FCA) in the United Kingdom, the Monetary Authority of Singapore (MAS), the Swiss Financial Market Supervisory Authority (FINMA), and the Australian Securities and Investments Commission (ASIC), among others. Each regulatory entity ensures that Saxo adheres to strict standards regarding capital adequacy, client fund segregation, and operational compliance.

Each regulatory entity ensures that Saxo adheres to strict standards regarding capital adequacy, client fund segregation, and operational integrity. This robust regulatory standing provides clients with added confidence, knowing that their accounts are protected by industry-standard practices and legal safeguards.

Saxo’s Regulated Entities

The table below summarizes all the regulated entities through which Saxo operates globally.

| Operating Country | Entity | Regulator | Protection Amount |

|---|---|---|---|

| Denmark | Saxo Bank A/S | Danish Financial Supervisory Authority (FSA) | €100,000 for cash, €20,000 for securities |

| UAE | Saxo Bank A/S | Danish Financial Supervisory Authority (FSA) and the Central Bank of the U.A.E | None |

| Brazil | Saxo Bank do Brasil Escritório de Rep. Ltda | Danish Financial Supervisory Authority (FSA) and the Czech National Bank | €100,000 cash and €20,000 securities |

| Czech | Danish Financial Supervisory Authority (FSA), Dutch Central Bank, and Authority for the Financial Markets | Saxo Bank A/S, Czech Republic | €100,000 cash and €20,000 securities |

| United Kingdom | Saxo Capital Markets UK Limited | Financial Conduct Authority (FCA) | £85,000 |

| Singapore | Saxo Capital Markets Pte. Ltd. | Monetary Authority of Singapore (MAS) | None |

| Switzerland | Saxo Bank (Schweiz) AG | Swiss Financial Market Supervisory Authority (FINMA) | CHF 100,000 |

| Italy | BG SAXO Società di Intermediazione Mobiliare S.p.A. | Italian Market Authority – Consob | €100,000 cash and €20,000 securities |

| Japan | Saxo Bank Securities Ltd. | Japanese Financial Services Agency (JFSA) | None |

| Hong Kong | Saxo Capital Markets HK Limited | Securities and Futures Commission in Hong Kong (SFC) | HKD 500,000 for securities |

| Australia | Saxo Capital Markets (Australia) Limited | Australian Securities and Investments Commission (ASIC) | None |

| Netherlands | Saxo Bank A/S Netherlands | Danish Financial Supervisory Authority (FSA), National Bank of Belgium, and Financial Services and Markets Authority | €100,000 cash and €20,000 securities |

| Belgium | Saxo Bank A/S Belgium Branch | Danish Financial Supervisory Authority (FSA), Banque de France, and Autorité Marche Financière (AMF) | €100,000 cash and €20,000 securities |

| France | Saxo Bank A/S French Branch | Danish Financial Supervisory Authority (FSA), Banque de France, and Autorité Marche Financial (AMF) | €100,000 cash and €20,000 securities |

Customer Support

Saxo offers a professional and well-structured customer support system designed to assist clients with timely, accurate, and helpful responses. Clients can access support via phone, live chat, email, and a secure in-platform messaging system. In addition, multilingual support is offered, allowing Saxo to provide localized support to its diverse global client base.

It is important to note that Saxo’s support is not offered around the clock. Its support follows a 24/5 schedule, aligning with global trading days while excluding weekends. However, its support structure is also complemented with a comprehensive help centre that covers frequently asked questions, platform guidance, account management, products and services, and technical issues.

Saxo’s support quality is further elevated for clients on higher-tier accounts. Platinum and VIP clients are provided with priority access to support services, while VIP clients receive a dedicated relationship manager for more strategic and personalised assistance. Overall, Saxo’s customer service infrastructure reflects its commitment to client satisfaction and operational excellence.

Final Verdict

Saxo stands out as a premium, multi-asset broker that successfully blends global market access, professional-grade platforms, competitive pricing, and a strong regulatory foundation. Its offering is best suited for active traders, professionals, algorithmic traders, high-net-worth individuals, and institutional clients.

While Saxo may not appeal to absolute beginners or low-budget traders due to its high minimum funding requirements for premium accounts, its strengths in platform functionality, asset coverage, and customer support more than compensate. Clients can also benefit from a well-structured fee system, low fees, and reliable execution.

In summary, Saxo is ideally positioned for those seeking a comprehensive and professional trading experience. It combines technology, transparency, and trust to offer a service that is both refined and effective, making it a compelling choice for traders with advanced needs and long-term investment goals.