eToro is one of the world’s most recognised online brokers, serving over 30 million users across 140 countries gloabally. The broker combines traditional investing with CFD trading, providing access to thousands of financial instruments, including stocks, crypto, and CFDs (on stocks, ETFs, currencies, indices, and commodities).

eToro stands out for its copy trading functionality, which allows users to follow and replicate the strategies of successful investors. The platform is ideally suited for beginner and intermediate traders seeking a simple, engaging, and community-driven investing experience, especially those interested in social or copy trading.

VISIT eToro →Broker Summary Table

| Established | 2007 |

| Headquaters | Tel Aviv, Israel |

| Regulation | FINRA(US), SEC (US), FCA (UK), CySEC (Europe), ASIC (Australia), SFSA (Seychelles), FSRA (UAE) |

| Rating | 4.5/5.0 ★ |

| Products | Stocks, Crypto, CFDs ( on Stocks, ETFs, Currencies, Indices, Cryptocurrency, and Commodities), Social Trading, Copy Trading, and Crypto Staking. |

| Maximum Leverage | Retail – 1:30 Professional – 1:400 |

| Platform | eToro Web Trading Platform and eToro Mobile App. |

| Account Opening | 1-3 Business Days |

| Account Types | Personal (Retail), Professional, Corporate, and Islamic. |

| Payment Methods | eToro Money, Credit/Debit Card (Visa, Mastercard, Maestro), Bank Transfer, PayPal, NETELLER, Skrill, Trustly, iDEAL, and Przelewy24. |

| Minimum Deposit | $50 |

| Account Currencies | USD, GBP, and EUR. |

| Fees | Stock and ETFs: 0% commission for U.S. stocks Spreads: Vary by asset. Notably higher in crypto and forex Crypto Fee: 1% flat fee per trade Inactivity Fee: $10/month after 12 months of no login activity |

| Customer Support | Live Chat, Email, and Help Center. |

| Ideal Users | Beginner Traders and Investors, Passive Investors, Social Traders, and Copy Traders. |

Pros

- Strong global regulatory framework.

- Beginner-friendly mobile and web platforms.

- Supports multiple asset classes.

- Offers crypto trading with wallet support.

- Multiple fast and secure payment methods.

- Low stock commission.

- Social and copy trading functionality.

- Active social community with over 30+ million users

- Transparent trader statistics for copy trading.

- Demo account with $100,000 in virtual funds for paper trading.

Cons

- Limited charting and technical analysis tools for technical traders.

- No access to advanced platforms like MT4, MT5, or TradingView.

- High CFD trading fees.

- $5 withdrawal fee.

- $10 inactivity fee for accounts with no logins in the previous 12 months.

- High currency conversion fee.

- Slow response times for customer support during high-volume periods.

- No phone support for customer service.

Product Offering

Etoro offers stocks, crypto, and CFDs (on stocks, ETFs, currencies, indices, and commodities), with over 7,000 instruments to trade or invest in. The broker also offers some unique features, including social trading, copy trading (CopyTrader), Smart Portfolios, and Crypto Staking.

Overall, eToro’s product catalogue is designed for casual traders and investors seeking portfolio diversification.

| Stocks | 6,000 stocks from 20 exchanges |

| ETFs | 700+ ETFs |

| Crypto | 130+ Cryptocurrencies |

| CFDs | 7000+ tradeable assets across stocks, ETFs, currencies, indices, and commodities. |

| Social Trading | A social community with over 30+ million users. |

| Copy Trading | eToro’s CopyTrader allows users to follow and replicate the strategies of successful investors. |

| Smart Portfolios | Allows passive investors to follow thematic strategies or market sectors without managing individual trades. |

| Crypto Staking | Allows users to earn monthly rewards when they buy and hold an eligible crypto asset. |

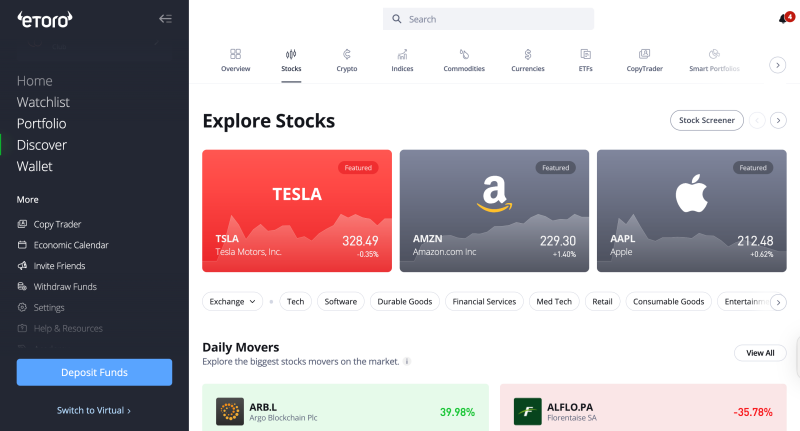

Trading Platform

eToro offers a proprietary web-based and mobile platform, which is one of the most user-friendly platforms in the industry. The interface of the platforms is clean, modern, and easy to navigate, with intuitive watchlists, price alerts, and a robust news feed. Social trading features are integrated directly within the platforms, encouraging community engagement through posts, comments, and copy trading.

While the eToro platform is built to be beginner-friendly, professional traders may find the lack of advanced charting tools and algorithmic trading options limiting. Also, Popular third-party platforms such as MetaTrader are not supported, which could be a drawback for those seeking advanced custom indicators or expert advisors.

Research and Tools

While eToro does offer basic research tools, such as daily market analysis, sentiment data, and a fundamental calendar, it falls short compared to brokers catering to advanced traders. The charting package includes more than 60 indicators and drawing tools, sufficient for most casual traders but not on par with specialist platforms.

eToro’s unique social feed, however, adds a community-driven layer of insight. Users who want to use the CopyTrader feature can track top-performing traders, view portfolios, and analyse their trading history and performance stats transparently. These extra elements supplement the limited proprietary research tools provided by eToro.

Account Opening

Opening an account with eToro is fully digital, straightforward, and takes only a few minutes to complete.

Account opening with eToro usually takes about 1 to 2 days, depending on how accurate and complete the information provided is. Applicants need to submit valid identification, proof of address, and complete a brief suitability questionnaire. This onboarding process ensures that eToro complies with regulatory requirements, prevents fraud, and aligns its services with the client’s financial profile, investment knowledge, and trading experience.

Account Types

eToro offers different account types to suit different client types. The account types available include a personal (retail) account, a professional account, and a corporate account. Islamic accounts are also available upon request. Additionally, all accounts come with a free demo account with $100,000 in virtual funds for clients to practice investing risk-free.

The table below provides an overview of the main account types offered by eToro and their descriptions:

| Account Type | Description |

|---|---|

| Personal (Retail) Account | An account for individual traders. It provides access to all available assets, the ability to copy other traders, and invest in Smart Portfolios with full consumer protection. However, the level of leverage that can be used is limited. |

| Professional Account | Designed for eligible traders who require higher leverage and advanced trading flexibility through a regulated professional account. |

| Corporate Account | An account designed for legal entities intending to trade using business capital through a dedicated corporate trading account. |

Fees

eToro provides a transparent trading fee structure; however, its fees are generally higher compared to some of its competitors. The fees for trading stocks and ETFs are low, which is appealing to cost-conscious investors. In contrast, the fees for trading cryptocurrencies and CFDs are relatively high compared to those of its competitors.

The table below contains a breakdown of eToro’s fees across various asset classes.

| Assets | Fees |

|---|---|

| Stocks and ETFs | $0 Commission. |

| Cryptocurrency | 1% for buying or selling crypto. |

| Options | $0 fees per contract $0.50 per contract (for non-US users) |

| CFDs | Currencies – From 1 pip Commodities – From 2 pips Indices – From 0.02 points Stocks and ETFs – 0.15% Cryptocurrencies – 1% |

Non-Trading Fees

With eToro, non-trading fees are where costs can add up. A $5 withdrawal fee is charged on every withdrawal, and an inactivity fee of $10 per month applies if an account remains idle for 12 consecutive months. Currency conversion fees are also applied if deposits or withdrawals are not made in USD.

The table below provides an overview of non-trading fees associated with eToro accounts.

| Account Fee | $0 |

| Custody Fee | $0 |

| Deposit Fee | $0 |

| Withdrawal Fee | $5 |

| Conversion Fee | 150 pips |

| Inactivity Fee | $10 after 1 year of inactivity |

Deposit and Withdrawal

Funding an eToro account is straightforward and flexible. Deposits can be made through bank transfers, credit/debit cards, PayPal, Skrill, Neteller, and other region-specific e-wallets. Minimum deposit requirements start at $50 but can be higher depending on the client’s country of residence.

The minimum withdrawal amount on eToro is $30. Withdrawals are processed within one to two business days, but always incur a $5 fee, which can significantly impact small withdrawal amounts.

While the funding process is straightforward, depositing or withdrawing in a different currency to your eToro account may incur a currency conversion fee of 150 pips for major currencies, which can add unexpected costs and reduce the overall value of your funds.

The table below provides an overview of eToro’s deposit and withdrawal options, including available methods, processing times, minimum amounts, and any applicable fees.

| Minimum Deposit | $50 – $10,000 (varies by country) |

| Supported Currencies | USD, GBP, and EUR. |

| Payment Methods | eToro Money, Credit/Debit Card (Visa, Mastercard, Maestro), Bank Transfer, PayPal, NETELLER, Skrill, Online Banking (Trustly), iDEAL, and Przelewy24. |

| Processing Time | eToro Money (GBP or EUR account) – Instant Withdrawal Bank Transfer – 2 to 10 Business days Credit/ Debit Card – 2 to 10 Business days E-Wallets – 2 Business Days |

Education

eToro offers a comprehensive suite of educational resources designed for beginner traders. Through its educational hub, eToro Academy, the broker offers video tutorials, courses, webinars, and step-by-step guides that cover trading basics, risk management, and platform walkthroughs.

However, advanced educational resources, such as in-depth strategy courses or professional webinars, are limited. For traders who rely on extensive education and ongoing mentoring, third-party platforms may be more suitable.

Regulation

eToro operates under a multi-jurisdictional regulatory framework, which adds an extra layer of trust and credibility. The broker is regulated by the Financial Conduct Authority (FCA) in the UK, the Securities and Exchange Commission (SEC), and the Financial Industry Regulatory Authority (FINRA) in the U.S., the Cyprus Securities and Exchange Commission (CySEC) in the EU, and the Australian Securities and Investments Commission (ASIC) in Australia, among others.

eToro’s Regulated Entities

The table summarizes the regulated entities through which eToro operates globally.

| Operating Country | Entity | Regulator | Protection Amount |

|---|---|---|---|

| USA | eToro USA LLC | Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA) | $500,000 |

| Europe | eToro (Europe) Ltd. | Cyprus Securities and Exchange Commission (CySEC) | €20,000 |

| United Kingdom | eToro (UK) Ltd. | Financial Conduct Authority (FCA) | £85,000 |

| Australia | eToro AUS Capital Limited | Australian Securities & Investments Commission (ASIC) | $1,000,000 |

| Singapore | eToro Singapore Pte. Ltd. | Monetary Authority of Singapore (MAS) | None |

| Middle East | eToro (ME) Limited | The Abu Dhabi Global Market (ADGM)’s Financial Services Regulatory Authority (FSRA) | None |

| Malta | eToro Money Malta Ltd | Malta Financial Services Authority (MFSA) | None |

| Gibraltar | eToro X Limited | Gibraltar Financial Services Commission (GFSC) | None |

| Other Countries | eToro (Seychelles) Limited | Financial Services Authority Seychelles (FSAS) | None |

Customer Support

eToro’s customer support is delivered through live chat, a ticketing system, and a comprehensive online Help Center. Response times for live chat are generally fast during business hours, although support is not offered via phone.

While the live chat, ticketing system, and help center address most common questions, we noticed that resolving more complex issues can take longer than desired.

Conclusion

eToro remains a compelling choice for beginners and intermediate traders who value ease of use, commission-free stock trading, and the unique social trading community. The proprietary platform is modern and user-friendly, and the CopyTrader feature sets eToro apart from most mainstream brokers.

However, high non-trading fees, limited advanced tools, and a lack of support for third-party platforms may deter experienced traders who require sophisticated research and customisable trading environments.

Overall, for traders seeking a simple, engaging, and community-driven investing experience, especially those interested in social trading or copy trading, eToro delivers strong value and remains one of the most recognisable names in the online brokerage space.